Digital Lending for India: Designed for Indian lenders, powered by Salesforce.

India’s financial sector is undergoing a rapid transformation. With the rise of fintechs and non-banking financial companies (NBFCs), the lending landscape is becoming more competitive. Borrower expectations are evolving faster than ever, creating a need for financial institutions to modernize and streamline their operations. To help meet this demand, Salesforce has introduced “Digital Lending for India”, a purpose-built digital lending solution tailored to the specific needs of Indian lenders.

Understanding the Digital Lending Landscape in India

The rise in smartphone usage, improved digital infrastructure, and expanding middle class have contributed to a surge in demand for loans—be it personal, home, or auto. Between FY20 and FY23, personal loan originations in India increased by 150%, with auto loans growing 63% in value. As competition heats up, financial institutions must offer more than just quick loans; borrowers now expect a seamless and personalized experience with minimal paperwork and faster decisions.

The rise in smartphone usage, improved digital infrastructure, and expanding middle class have contributed to a surge in demand for loans—be it personal, home, or auto. Between FY20 and FY23, personal loan originations in India increased by 150%, with auto loans growing 63% in value. As competition heats up, financial institutions must offer more than just quick loans; borrowers now expect a seamless and personalized experience with minimal paperwork and faster decisions.

However, lenders face challenges with fragmented legacy systems, compliance with regulations such as Aadhaar and KYC, and ever-evolving customer demands. To stay competitive, they need to adopt solutions that enhance operational efficiency and deliver better borrower experiences.

Salesforce Digital Lending for India: A Game-Changer for Financial Institutions

At the Salesforce World Tour Essentials Mumbai, Salesforce unveiled “Digital Lending for India”—a unified, scalable platform designed to help banks, NBFCs, and other financial services institutions streamline their loan origination processes, enhance decision-making, and improve customer engagement.

Salesforce loan origination system integrates the following key features, all designed to address the unique requirements of India’s financial ecosystem:

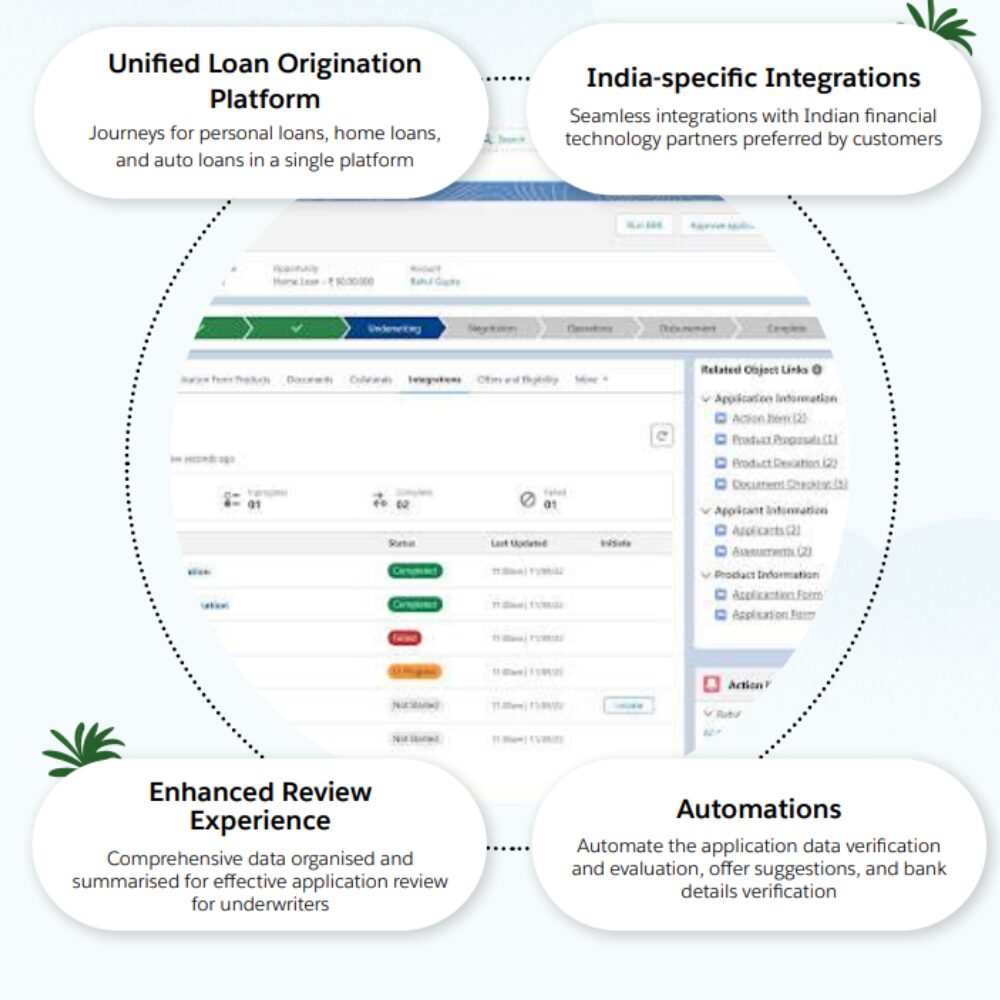

1. Unified Loan Origination Platform

“Digital Lending for India” consolidates the loan origination process for personal, home, and auto loans into a single, unified platform. This allows lenders to streamline operations, reduce costs, and provide a more personalized experience to their borrowers. By eliminating the need for multiple systems, financial institutions can improve efficiency and accelerate loan approvals.

2. Enhanced Review Experience

The platform provides a consolidated and organized view of borrower data, making it easier for underwriters to review applications quickly and accurately. Comprehensive data is presented in a way that simplifies decision-making, reducing errors and ensuring faster processing of loans. This leads to higher productivity and improved borrower satisfaction.

3. India-Specific Integrations

A standout feature of “Digital Lending for India” is its seamless integration with key Indian fintech partners and regulatory systems. These integrations include Aadhaar authentication, KYC compliance, and bank verification (e.g., IFSC). This enables lenders to speed up customer onboarding while ensuring full compliance with Indian regulations, offering a frictionless experience for both the lender and the borrower.

4. Automations

Automation is at the heart of this platform. The Digital Lending Platform automates critical tasks such as application data verification, loan decisioning, and bank detail verification for fintech business loans. These automated workflows dramatically reduce the turnaround time from application intake to loan disbursement, allowing lenders to process more loans in less time. This not only improves operational efficiency but also provides borrowers with a faster and more responsive experience.

Benefits of Salesforce Digital Lending for India

The benefits of adopting “Digital Lending for India” extend far beyond efficiency. The platform enhances borrower satisfaction, speeds up loan processing, and enables financial institutions to grow their business without the constraints of legacy systems. By consolidating loan products and services into a single platform, lenders can offer personalized loans with faster approvals and minimal friction.

Kotak Mahindra Bank, for example, consolidated 12 systems into a single omni-channel service platform, dramatically improving customer engagement and service consistency across different touchpoints.

Hero FinCorp also benefited from Salesforce’s platform by implementing a self-service mobile app that now resolves 40% of customer queries without the need for agent intervention.

The Future of Digital Lending in India

India’s digital lending market is projected to reach $515 billion by 2030, and the future is clearly digital-first. Financial institutions that invest in modern, scalable solutions like *Salesforce Digital Lending for India* will be well-positioned to thrive in this evolving market. The integration of AI-driven risk assessments, real-time automation, and seamless customer experiences will redefine how loans are processed and delivered.

Transform Your Lending Journey Today

Salesforce Digital Lending for India offers a comprehensive solution for lenders looking to enhance their operational efficiency and improve borrower experiences. By unifying loan origination, leveraging automation, and integrating with India-specific systems, your institution can scale its operations, reduce costs, and offer a superior lending experience.

Ready to revolutionize your lending operations? Contact us today to learn more about how Digital Lending for India solution can help your business accelerate growth and deliver exceptional results in a rapidly changing market.

Nilamani Das

Nilamani is a thought leader who champions the integration of AI, Data, CRM and Trust to craft impactful marketing strategies. He carries 25+ years of expertise in the technology industry with expertise in Go-to-Market Strategy, Marketing, Digital Transformation, Vision Development and Business Innovation.