Without an iota of doubt, innovation is the key to carving a niche for your business in today’s competitive world. Nevertheless, businesses in all spheres are always challenged to deliver the best customer experiences, user interface behaviors, and so on.

Experimenting with advanced Lead to Cash processes seems to be the new age mantra to achieve maximization in productivity and customer experiences. Business goals become achievable with the correct lead to cash implementation and execution. No doubt, optimizing your business processes and enterprise systems can bring on a series of advantages for your business.

This article talks in detail about what this ‘Lead to Cash’ is, how the lead to cash flow can affect your business positively and what are the key focus areas.

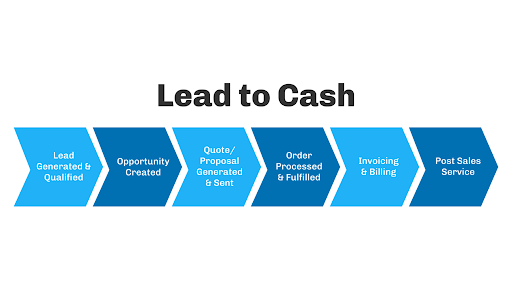

What is ‘Lead to Cash’?

‘Lead to Cash’ is an integrated business process that combines multiple SAP solutions with artificial intelligence (AI) and experience management models. Simply put, it essentially spans your entire business process chain from initial customer contact to the final order completion stage with service delivery.

Optimizing your business processes from lead generation to lead to cash process flow helps reinforce better business models and transformations.

Having understood what the Lead to Cash cycle is, we now move forward to highlighting the integral place it can take for your business expansion, management, and growth.

Why is ‘Lead to Cash’ important for your business?

Customer demands and expectations are changing, which requires businesses to take on new transformations in their processes, technology, and ways of working.

More than often, businesses find themselves struggling with maintaining consistency, transparency, and efficiency in managing databases, technology innovations, and systems that differ across departments. Collating sales and marketing, accounting, operations, and other cores with end-to-end business software solutions like ‘Lead to Cash’ can prove highly beneficial.

Making your business processes streamlined and well-integrated, Lead to Cash is the go-to business transformation you are looking at.

What it does for the business is actually an endless list of benefits such as removing process inefficiencies, flawless reporting, enhancing business performance (on multiple grounds), driving sales insights, forecasting future trends, and so on.

Here’s a list of 5 reasons why you just cannot ignore ‘Lead to Cash’ for your business:

- It enables your business to innovate better with greater flexibility.

- It helps your business enable new business models.

- It supports your business’s transition from classic sales of physical products to service sales and subscription sales.

- It improves business productivity through enhanced interface behavior and advanced systems.

- It effectively improves the overall experiences of your end customers or users.

Common Challenges in the Lead-to-Cash Process

Despite its importance, many businesses face challenges in implementing a smooth Lead-to-Cash process. Here are some common hurdles:

- Fragmented Data: Data silos across different systems can cause delays and errors. Check out how CEPTES can help you to streamline your integrations here!

- Manual Processes: Relying on manual workflows increases the risk of human error and slows down operations.

- Misaligned Teams: Lack of coordination between sales, marketing, and finance can create bottlenecks.

- Late Payments: Inefficient invoicing or follow-ups can lead to delayed payments and cash flow issues.

ALERT: Things to lay your attention on!

Redirecting your focus and manpower hours on certain things or areas can enable your business to achieve maximized output and results. When it comes to advancing your struggling business with the aid of ‘Lead to Cash’, you must sideline a few avoidable extras and keep in mind certain necessary cores.

Here’s a list of 5 must-focus areas for you in this process:

- MARKETING AUTOMATION: Nurturing your business leads right from the first initiation to the final order placement is essential. This can be better managed by a full-proof marketing automation system. They help your sales team to make the most of every opportunity, converting prospective leads into customers, using insights for future sales, and lead scoring.

- SALES MANAGEMENT: Optimizing your sales CRM which serves as the common database connecting different departments is a must to offer higher customer experiences. Adapting your business to standardized data silos, integrated end-to-end process workflows and the many other offerings of a ‘Lead to Cash’ system is rational and wise.

- ORDER FULFILLMENT: A greater focus must be laid on managing the final customer orders in a way that is efficient, transparent yet accurate. Automated workflows do wonders for operational processes.

- CUSTOMER SERVICE: Identifying the various opportunities of customer service and sales is integral. This can be well managed with a responsive team, communication between different departments, quick renewal and order cancellation processes, etc. Using integrated Service Clouds can help ease out the otherwise complex service environments.

- REVENUE MANAGEMENT: Focus on how you manage your revenues. Yes, even if you manage all the core business processes finely but lag in collecting payments from your customers, it can be a great issue. An integrated ‘Lead to Cash process’ in place can effectively help you to source and manage your revenues.

Key Integrations for a Seamless Lead-to-Cash Process in Salesforce

| Title | Stage | Salesforce Tools | Relevant Integrations |

|---|---|---|---|

| Lead Generation & Marketing Automation | Capture leads through marketing campaigns and nurture them to sales readiness. | Salesforce Marketing Cloud, Pardot |

CRM (Sales Cloud): Transfer marketing-qualified leads (MQLs) to Sales. Third-Party Tools: Google Ads, LinkedIn Campaign Manager for ad performance tracking. Analytics (Tableau): Monitor campaign performance in real time. |

| Lead Qualification & Opportunity Management | Identify qualified leads and convert them into opportunities in Salesforce. | Sales Cloud |

Marketing Automation (Pardot): Access lead scores and engagement metrics. CPQ (Salesforce CPQ): Generate quotes aligned with opportunity stages. Data Enrichment Tools: ZoomInfo or Clearbit for complete lead profiles. |

| Quoting & Proposal Generation | Configure products, set prices, and create accurate quotes for customers. | Salesforce CPQ |

ERP (NetSuite, SAP): Pull product availability and pricing data. eSignature (DocuSign, Adobe Sign): Enable digital signature of proposals and contracts. Document Management (CloudFiles): Store and manage sales collateral. |

| Order Management & Contract Execution | Finalize contracts and manage orders efficiently within Salesforce. | Sales Cloud, Salesforce Contracts |

ERP (Oracle NetSuite, SAP): Sync order and inventory details. Payment Gateways (Stripe, PayPal): Process down payments and invoices. eSignature (DocuSign): Finalize contracts digitally. |

| Billing & Invoicing | Generate invoices and manage payment collections. | Revenue Cloud |

Finance and Accounting (QuickBooks, Zohobooks): Automate financial reports and reconciliations. Subscription Management (Zuora, Chargebee): Handle recurring billing for subscription-based models. Payment Gateways (Razorpay, Stripe): Manage invoice payments and notifications. |

| Fulfillment & Delivery | Ensure timely delivery of products or services to customers. | Sales Cloud, Service Cloud |

ERP (SAP, Oracle): Track product availability and delivery status. Logistics Platforms (FedEx, UPS): Monitor shipping and delivery timelines. Customer Support Tools (Zendesk, Zoho): Handle delivery-related queries. |

| Customer Support & Case Management | Provide post-sale support to ensure customer satisfaction and retention. | Service Cloud |

ERP (SAP, Microsoft Dynamics): Access product and order details for troubleshooting. Live Chat (Salesforce Chat, Intercom): Offer real-time support. Knowledge Base Tools (Confluence): Share support documentation with customers. |

| Revenue Recognition & Financial Reporting | Recognize revenue and generate financial reports. | Revenue Cloud, Tableau |

Finance Systems (SAP, QuickBooks): Automate revenue tracking and reporting. Analytics (Tableau, Power BI): Generate dashboards for real-time revenue insights. Compliance Tools (SOX, ASC 606): Ensure financial compliance and audit readiness. |

| Analytics & Performance Tracking | Track performance and optimize the lead-to-cash process. | Tableau CRM (formerly Einstein Analytics) |

Sales Cloud & Service Cloud: Aggregate data from multiple Salesforce clouds. ERP and Finance Systems: Track sales performance and revenue trends. Marketing Automation: Analyze campaign ROI and customer acquisition costs. |

| Renewal & Upsell Opportunities | Identify opportunities to renew contracts and offer to upsell or cross-sell products. | Sales Cloud, Service Cloud |

Subscription Management (Zuora, Chargebee): Automate renewal processes. CRM (Sales Cloud): Track contract renewal dates and upsell opportunities. Marketing Automation (Pardot): Launch renewal or upsell campaigns. |

Wrap-up

To conclude, ‘Lead to Cash’ streamlines your varied business processes. It is your best way to achieve better business performance, enhanced communication, improved coordination, increased flexibility, real-time information sharing, sales, and forecasting, etc. To know more, connect with us.

FAQs

1. What is the Lead-to-Cash Process?

The Lead-to-Cash (L2C) process is an end-to-end business workflow that begins with generating leads and continues through opportunity management, order fulfillment, invoicing, and payment collection. It connects sales, marketing, operations, and finance into a seamless flow to ensure that potential customers become paying customers efficiently.

2. How Can Lead to Cash Improve Business Productivity?

Implementing a Lead-to-Cash process improves productivity by:

- Streamlining workflows between departments like sales, operations, and finance.

- Reducing manual processes with automation, lowering the chance of human error.

- Providing real-time insights into sales performance and revenue forecasts.

This results in faster order fulfillment, improved customer experience, and enhanced sales processes.

3. What Are Some Common Challenges Businesses Face with Lead-to-Cash?

Businesses often encounter the following hurdles when implementing L2C processes:

- Fragmented Data: Inconsistent data across systems creates bottlenecks.

- Manual Processes: Relying on non-automated workflows slows down operations.

- Misaligned Teams: Poor coordination between sales, finance, and marketing creates inefficiencies.

- Delayed Payments: Ineffective invoicing and collection processes impact cash flow.

Addressing these challenges requires strong system integration and cross-functional collaboration.

4. Why Is Lead-to-Cash Important for Customer Experience?

The Lead-to-Cash process directly influences the customer journey by ensuring smooth transitions from marketing and sales to order delivery and service support. By integrating CRM tools and automated processes, businesses can:

- Provide faster, personalized interactions.

- Ensure on-time order fulfillment.

- Respond quickly to inquiries, renewals, or cancellations, enhancing customer satisfaction and loyalty.

5. What Key Areas Should Businesses Focus On for Effective Lead-to-Cash Implementation?

To optimize the Lead-to-Cash process, businesses should focus on:

- Marketing Automation: Nurture leads effectively from first contact to order placement.

- Sales Management: Ensure smooth collaboration between teams using integrated CRM tools.

- Order Fulfillment: Automate workflows to manage customer orders efficiently.

- Customer Service: Provide exceptional post-sale support and quick responses to customer needs.

- Revenue Management: Maintain healthy cash flow through timely invoicing and payment collection.